DIR Creating Large Taxpayer Unit for 50 Biggest Companies

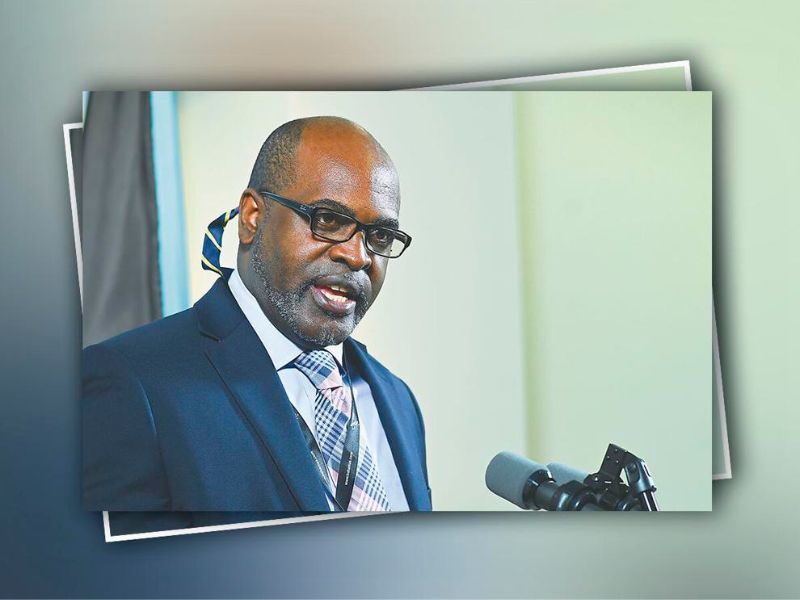

The Department of Inland Revenue (DIR) is developing an office to service solely the 50 biggest companies that supply 50 percent of the government’s revenue, calling that new office the Large Taxpayer Unit (LTU), Financial Secretary Simon Wilson explained yesterday, adding that these businesses will also be responsible for paying value-added tax (VAT) within a shorter time frame.

Wilson, who made the remarks while speaking at the Bahamas Hotel and Tourism Association’s (BHTA) board of directors meeting, said the department hopes to have the unit operational by this fall.

He told the BHTA meeting that many of the businesses operating in the tourism sector are part of the 50 biggest taxpayers.

“Essentially, around 50 businesses account for a disproportionate share of our revenue,” said Wilson.

“We have 50,000 businesses registered and about 50 of them account for half of the revenue that we actually collect. So, you can see the disproportionate nature of that. And so we believe that these businesses require, I will say, a greater level of service, more efficient services, because they are so critical to our fiscal outcomes.

“We are in the last stages of creating the Large Taxpayer Unit, and these businesses will be required to pay VAT, not within 21 days as the other businesses, but within a shorter time frame.”

Wilson said these 50 businesses will be contacted directly to be apprised of the benefits of the LTU.

Acting Comptroller at the DIR Shunda Strachan, who also addressed the BHTA meeting, explained that there have been challenges collecting taxes from smaller hotels in the Family Islands. She said the DIR plans to begin sending agents to the Family Islands to assist those properties with their compliance issues. According to Strachan, the larger hotels have been largely compliant.

“Starting actually in August, we will be making monthly trips around the Family Islands to just check on whether the smaller hotels are registered and doing the things that they’re supposed to do,” she said.

“It’s easier to kind of monitor the big boys. It has been a bigger challenge to monitor the smaller properties, especially those on the Family Islands. So we are going to be approaching that area of revenue shortages this year.”

By Ayhisha Small